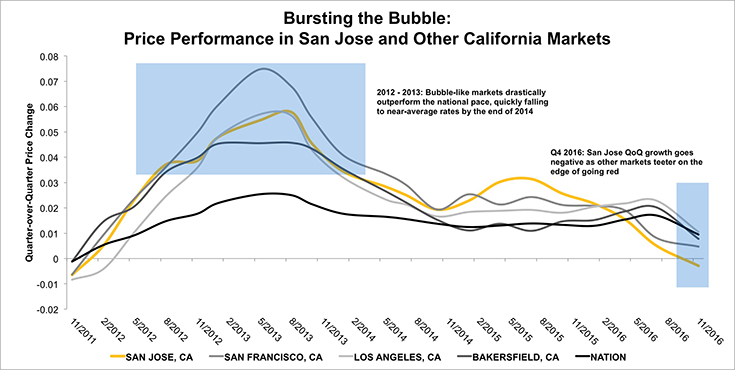

Home prices in San Jose, Calif.—one of the nation’s leading markets since the bust—posted negative 0.3 percent last quarter, marking the area’s first foray into the red in five years with currently the lowest quarterly growth rate in the country, according to Clear Capital’s recent Home Data Index (HDI) Market Report. With the San Jose area leading price movement in California, is the bubble out West about to burst?

“San Jose going negative over the last quarter is a huge deal, although no surprise given that growth in this market, and the Bay Area region as a whole, has greatly slowed over the last couple of years,” says Alex Villacorta, vice president of Research and Analytics at Clear Capital. “Rapid price growth combined with lagging, sticky income levels quickly pushed home prices out of the affordable range for a majority of homebuyers, which is a key factor in this market’s recent downturn in performance. For this metro, turn times have slowed for both performing and distressed properties as demand has begun to slack, finally pulling the area into the red during this real estate slow season.”

Other markets in California are also positioned to pop, according to the report, including Bakersfield, Los Angeles and San Francisco, which posted quarter-over-quarter growth of approximately 1.0 percent—an underperformance relative to last year.

Their growth paralleled the overall quarter-over-quarter growth of the Midwest, South and West regions, according to the report. The Northeast, notably, saw 0.5 percent quarter-over-quarter growth, a significant segue out of its slow state. Quarter-over-quarter growth nationally, to compare, continued at 0.9 percent.

Their growth paralleled the overall quarter-over-quarter growth of the Midwest, South and West regions, according to the report. The Northeast, notably, saw 0.5 percent quarter-over-quarter growth, a significant segue out of its slow state. Quarter-over-quarter growth nationally, to compare, continued at 0.9 percent.

Source: Clear Capital

Related Posts

- US pending home sales stuck at 22-year low despite dip in rates

- Home prices kept climbing even as existing home sales tanked last month

- Existing home sales sank to slowest pace in 30 years in 2023

- Home prices could jump 5% in the next 12 months as high mortgage rates freeze the housing market, Zillow economists say

- Homebuyers are ‘losing patience,’ no longer on the sidelines: survey

- Housing market predictions: The forecast for the next 5 years

- We’re entering a brutal new era for the housing market

- Homebuilders are liking today’s housing market

- Homeowners Are Increasingly Reluctant to Sell, But Not For The Reason You’d Expect

- The US housing market is set to cool this fall, setting up a rare opportunity for buyers as sellers slash prices, Zillow says