Although the US housing market shows signs of stabilizing, excess inventory and shadow supply could hinder recovery, according to economists at government-sponsored enterprise Fannie Mae (FNM: 1.21 -2.42%).

Despite “encouraging” recent growth in consumer spending, Fannie said economic growth likely decelerated from an annualized 5.6% in Q409 to 2.7% in Q110. Economists project a 3.1% rate of economic growth for all of 2010, according to the April outlook report by the Fannie Mae economics and mortgage market analysis group (download here).

“Financial conditions are improving as seen by the unwinding of various programs, most notably the [mortgage-backed securities] purchase program which ended in March,” said Fannie Mae chief economist Doug Duncan. “This is strong evidence that the [Federal Reserve] believes the financial sector can stand on its own.”

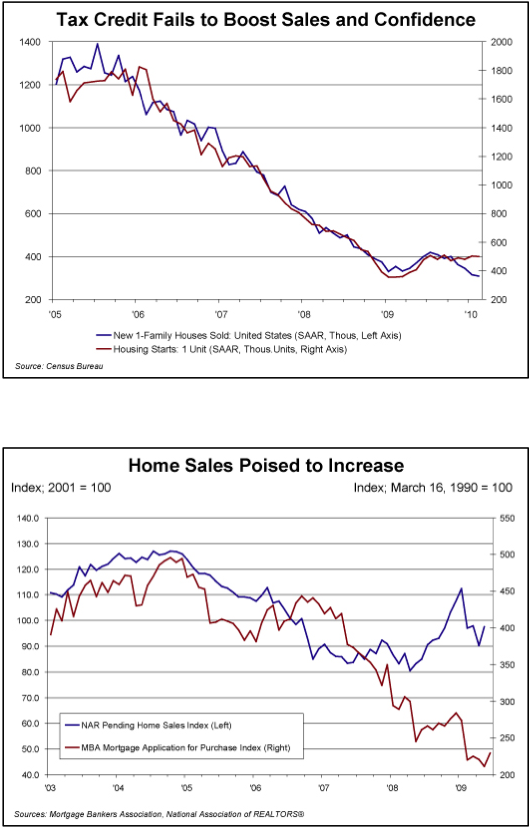

Fannie said new home sales will likely be slow to recover until inventory of existing homes and the foreclosure overhang are worked off. Economists see key indicators for existing home sales — including pending home sales and purchase applications — are showing good signs of a pickup.

Although the first-time homebuyer tax credit failed to markedy boost sales, home sales look poised to increase:

“We estimate that June 2009 was the end of the recession, a good sign that we’re moving forward,” Duncan said. “Nevertheless, significant improvements in the labor market and consumer spending will be the big hurdles as we move toward recovery in the housing market and broader economy.”

Despite some positive growth in March labor stats, unemployment will likely remain elevated for some time, Fannie said. Economists project unemployment will decline to 9.4% by year-end, and to 8.5% by the end of 2011.

Housing starts are projected to climb from 595,000 in Q110 to 800,000 in Q410, and to 1.2m by Q411. Total home sales are expected to rise from 5.5m in Q110 to 6m by Q410, and to 6.8m by year-end 2011.

At the same time, median new home prices are expected to climb from $207,200 in Q110 to $214,500 by Q410, and to $217,900 by Q411. Fannie projected median existing home prices to rise from $167,200 in Q110 to $168,300 in Q410, and to $171,000 by year-end 2011.

Mortgage rates are likely to increase. Fixed-rate mortgages are projected to gain 43 basis points (bps) in 2010, rising from an average 5% in Q110 to 5.43% in Q410, and gaining another 38bps to end 2011 at an average 5.81%.

Fannie economists also expect quarterly mortgage originations to dip from $321bn in Q110 to $291bn in Q410, before ticking up to as much as $418bn in Q311 and settling year-end 2011 at $387bn. The refinance share of mortgage originations is likely to slip from 65% in Q110 to 36% in Q410. The refi share should uptick slightly in early 2011 before ending the year at 36% in Q411.

Related Posts

- Falling home prices are raising the risk of a deeper correction as the housing market cracks under high mortgage rates

- Here’s the latest sign that the US housing market has frozen over

- Real Estate Broker Says $600K Homes Will Hit $1 Million — ‘I Hate To Burst Your Bubble, But There Is No Bubble And There Never Will Be’