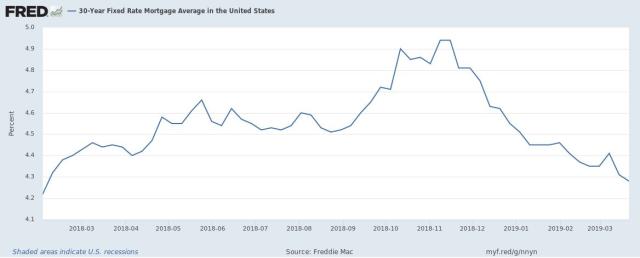

Mortgage rates are at the lowest in more than a year, with the 30-year fixed rate now averaging 4.28%. This is according to weekly data compiled by Freddie Mac.

The last time rates were this low was February 2018, and this is a 13% drop since November’s high of 4.94%, which was the highest since February 2011.

Right now, the rates represents good news for home buyers hoping lower costs as well as stability in the mortgage market.

“Our latest thinking is that they’ll stay close to the level,” said Mike Fratantonia, SVP and chief economist at the Mortgage Bankers Association.

Rates are lowest in over a year for 30-year fixed mortgages. (St. Louis Fed)

Rates are lowest in over a year for 30-year fixed mortgages. (St. Louis Fed)

The lower mortgages rates coincide with the recent Federal Reserve meeting. Besides leaving interest rates alone and signaling no hikes for the rest of 2019, the Fed also said it could soon stop shrinking its balance sheet.

Still, factors remain that could cause rates to rise. Should inflation prompt the Fed to hike rates again, this could have an effect on mortgage rates. But more importantly, the Fed signaled it may sell off its “residual holdings” of mortgage-backed securities from its balance sheet, which could put upward pressure on mortgage rates.

This, however, is a move which Frantantonia expects would come with plenty of advanced notice.

In the broader housing picture, the decline and positive outlook for mortgage rates comes at a time when the housing market has a lot of things going for it.

“Unemployment is 3.8%, the lowest in 20 years, wage growth has picked up 3.4% for hourly employees over the past 12 months, and households are comfortable in their financial situation,” said Fratantonia. And more millennials are entering the market for the first time.

The biggest question for a while has been housing inventory: a growing demand but shortage of units on the market has put upward pressure on home prices in the recent past.

But “this year we’re beginning to see an increase in homes on the market,” said Frantantonia. “Some of that comes from a pickup in construction, but you’re also seeing listings in existing homes, potentially breaking up the logjam in the market.”

Average U.S. mortgage rates have been falling. (AP Photo/Steven Senne)

Average U.S. mortgage rates have been falling. (AP Photo/Steven Senne)

One thing this means is that people upgrading from a first home to a new one may free up inventory for first-time homebuyers in the market.

Though mortgage rates have been falling, the only people able to take advantage would be people looking to refinance who got mortgages recently. A refinancing boom or boomlet remains unlikely because rates had already been low, so much of the potential refinancing had already happened.

For buyers, the recent drop in rates isn’t likely to have a large impact. According to Frantantonia, rates are only a small part of the buying equation, though a hike in mortgage rates can cause problems as rates set people’s budget.

The problem last year, according to MBA, was that the quickly-increasing rates and tight inventory made it difficult because people if people had to outbid others, enough time may have passed in which rates increased and a bidder’s budget may have contracted.

“This year will be much better,” said Frantantonia. “Someone can set a budget with rates being stable and with more inventory, I think we’ll have more success on the market.”

-

Ethan Wolff-Mann is a writer at Yahoo Finance focusing on consumer issues, personal finance, retail, airlines, and more. Follow him on Twitter @ewolffmann.

Related Posts

- US pending home sales stuck at 22-year low despite dip in rates

- Home prices could jump 5% in the next 12 months as high mortgage rates freeze the housing market, Zillow economists say

- Homebuyers can’t get a break as mortgage rates march back toward 7%

- The US housing market is set to cool this fall, setting up a rare opportunity for buyers as sellers slash prices, Zillow says

- Home prices kept climbing even as existing home sales tanked last month

- Housing market predictions: The forecast for the next 5 years

Tags: Housing Market News, Mortgage