Pending home sales stepped back in July and have now fallen on an annual basis for seven straight months, according to the National Association of Realtors®.

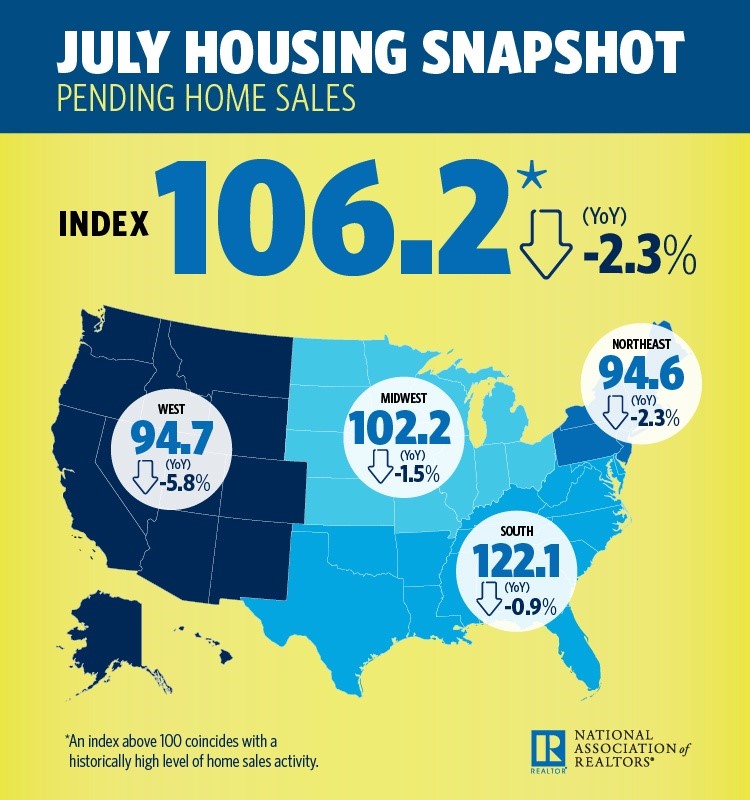

The Pending Home Sales Index, a forward-looking indicator based on contract signings, decreased 0.7 percent to 106.2 in July from 107.0 in June. With last month’s decline, contract signings are now down 2.3 percent year-over-year.

Lawrence Yun, NAR chief economist, says the housing market’s summer slowdown continued in July. “Contract signings inched backward once again last month, as declines in the South and West weighed down on overall activity,” he said. “It’s evident in recent months that many of the most overheated real estate markets – especially those out West – are starting to see a slight decline in home sales and slower price growth.”

Added Yun, “The reason sales are falling off last year’s pace is that multiple years of inadequate supply in markets with strong job growth have finally driven up home prices to a point where an increasing number of prospective buyers are unable to afford it.”

Pointing to annual changes in active listings data at realtor.com®, Yun said increasing inventory in several large metro areas, and especially many out West, will likely help cool price growth to more affordable levels going forward. Even as days on market remains swift in many of these areas, Denver, Santa Rosa, California, San Jose-Sunnyvale-Santa Clara, California, Seattle, Nashville, Tennessee, and Portland, Oregon were among the large markets seeing a rise in active listings in July compared to a year ago.

Earlier this week, NAR released commentary reflecting on the past decade since the beginning of the Great Recession. Although supply and affordability headwinds are the biggest issue right now, Yun said it is important to note just how much the housing market has recovered since the depths of the financial crisis. Today, thanks to several years of solid job growth, as well as safe lending and regulatory policy reforms, foreclosures sit near historic lows and record high home values have helped millions of households build substantial wealth.

“Rising inventory levels – especially if new home construction finally starts picking up – should help slow price appreciation to around two-and-four percent, which will help aspiring first-time buyers, and be good for the long-term health of the nation’s housing market,” said Yun.

Yun expects existing-home sales this year to decrease 1.0 percent to 5.46 million, and the national median existing-home price to increase around 5.0 percent. Looking ahead to next year, existing sales are forecast to increase 2 percent and home prices around 3.5 percent.

July Pending Home Sales Regional Breakdown

The PHSI in the Northeast climbed 1.0 percent to 94.6 in July, but is still 2.3 percent below a year ago. In the Midwest the index inched up 0.3 percent to 102.2 in July, but is still 1.5 percent lower than July 2017.

Pending home sales in the South declined 1.7 percent to an index of 122.1 in July, and are 0.9 percent below a year ago. The index in the West decreased 0.9 percent in July to 94.7, and is 5.8 percent below a year ago.

Related Posts

- Here’s the latest sign that the US housing market has frozen over

- Falling home prices are raising the risk of a deeper correction as the housing market cracks under high mortgage rates

- Home Values Dropping In 27 Of 50 U.S. States As The Housing Market Shifts Amid Continuing High Interest Rates, Zillow Data Shows

- US existing home sales unexpectedly fall in April

- U.S. home prices are dropping the most in these regions

- New home sales fall to seven-month low in May; supply increases

- Lower prices boost new US home sales; outlook downbeat amid higher mortgages

- Simon Property Group reports rise in quarterly real estate FFO on strong leasing demand